White Paper

Introduction to the Problem Analysis

The modern market of referral programs, distribution companies, and crypto projects faces a number of systemic issues that limit opportunities for participants and hinder the creation of sustainable income and long-term asset accumulation.

Although millions of people around the world are engaged in distribution companies, affiliate programs, and digital assets, only a few manage to build real capital from these models — capital that could provide lasting financial stability.

Our goal was to conduct an in-depth analysis of these issues to understand:

- why most existing models fail to help people move beyond one-time earnings,

- and what needs to change in order to empower participants not just to earn, but to build capital that stays with them and can be passed on to future generations

As part of the research, we examined:

- the limitations of traditional distributor products (such as wellness and cosmetics),

- the weaknesses of most crypto and NFT projects,

- and the shortcomings of classic referral systems.

The objective of this study was to identify the real market problems that our product must address, so that participants can not only generate income here and now, but also build a long-term source of capital that:

- can be inherited,

- grows alongside the project,

- and is protected from volatility and market crises.

As a result, we identified seven key problems that no known market is currently solving. These challenges became the foundation for developing a unique business model that combines the capabilities of NFTs with an effective referral system — answering all of these unmet needs.

Problem 1: Most products target either traditional MLM distributors or crypto-native users — rarely both

There is no product on the market that is equally accessible and understandable to both distributors and the crypto audience.

- Traditional distribution companies operate offline through personal sales, which limits team building to one’s circle of acquaintances.

- Crypto projects are designed exclusively for Web3-native users and remain incomprehensible to the majority of Web2 participants — including distributors, small business owners, and freelancers, who represent over 70% of all global affiliate program participants (according to DSA, 2023).

As a result, it is difficult to build a truly global team or scale a business beyond one’s immediate network.

Supporting data:

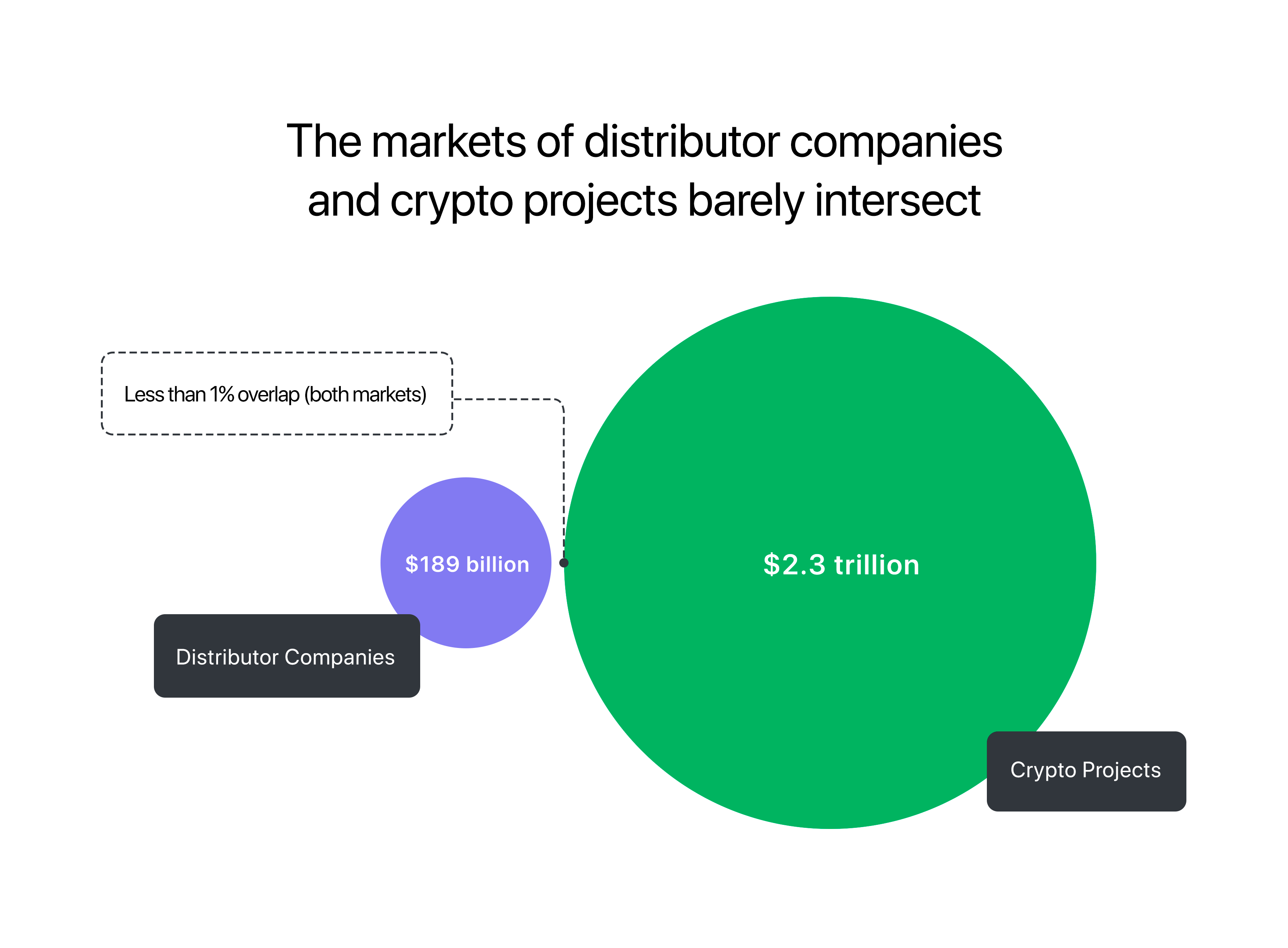

According to Forbes and Statista, the global direct selling market is valued at $189 billion, while the cryptocurrency market exceeds $2.3 trillion. However, 99% of existing products target either Web2 users (distributors and entrepreneurs) or Web3 users exclusively, failing to bridge the gap between these two massive markets.

Problem 2: Referral programs often face payout issues and country restrictions

Most distributor companies and referral-based projects struggle with payment-related challenges:

- delays, transfer limits, and country restrictions,

- bank blocks and sanctions,

- difficulties for international participants

These issues hinder business development and undermine trust in the project.

Supporting data:

According to DSA and PwC, up to 35% of participants in distribution companies experience problems with payouts and withdrawing funds.

Problem 3: Products in distributor companies are not investment tools

The majority of distributor company products are purchased for personal consumption only, not for resale at a profit.

- These are typically everyday goods — wellness products, cosmetics, supplements — that lose both consumer and market value immediately after purchase.

- They cannot be profitably resold, as there is virtually no secondary market for such products.

- Even in rare cases where a product becomes scarce, it is not purchased at a price higher than the original retail value.

Participants are not able to earn through resale or preserve products as assets that could increase in value.

Supporting data:

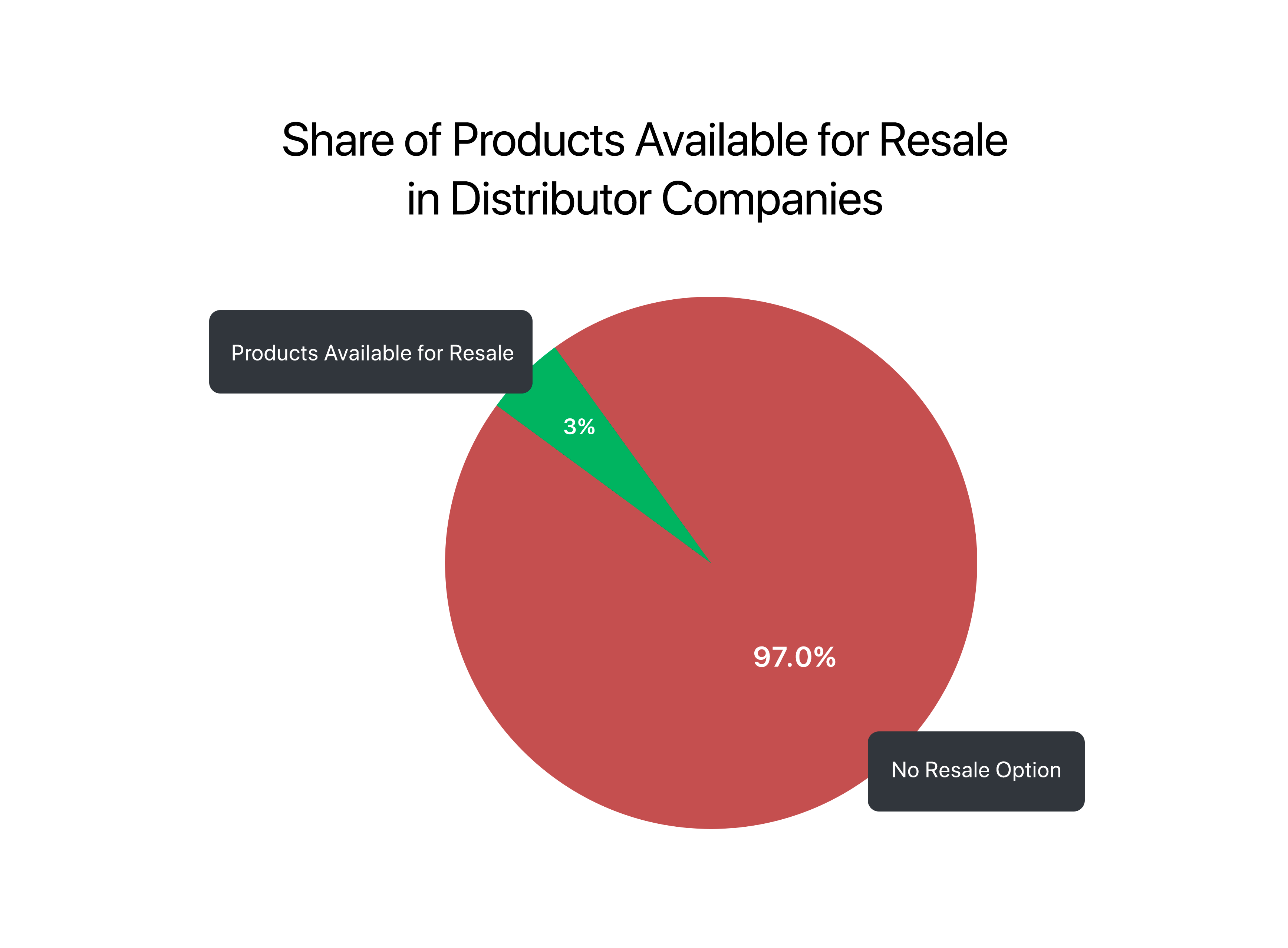

According to Statista, the secondary market for these categories represents less than 3% of the primary market. This confirms that such products are not considered assets and do not enable income through value growth or resale.

Problem 4: Distributor company products can be produced endlessly, which devalues them

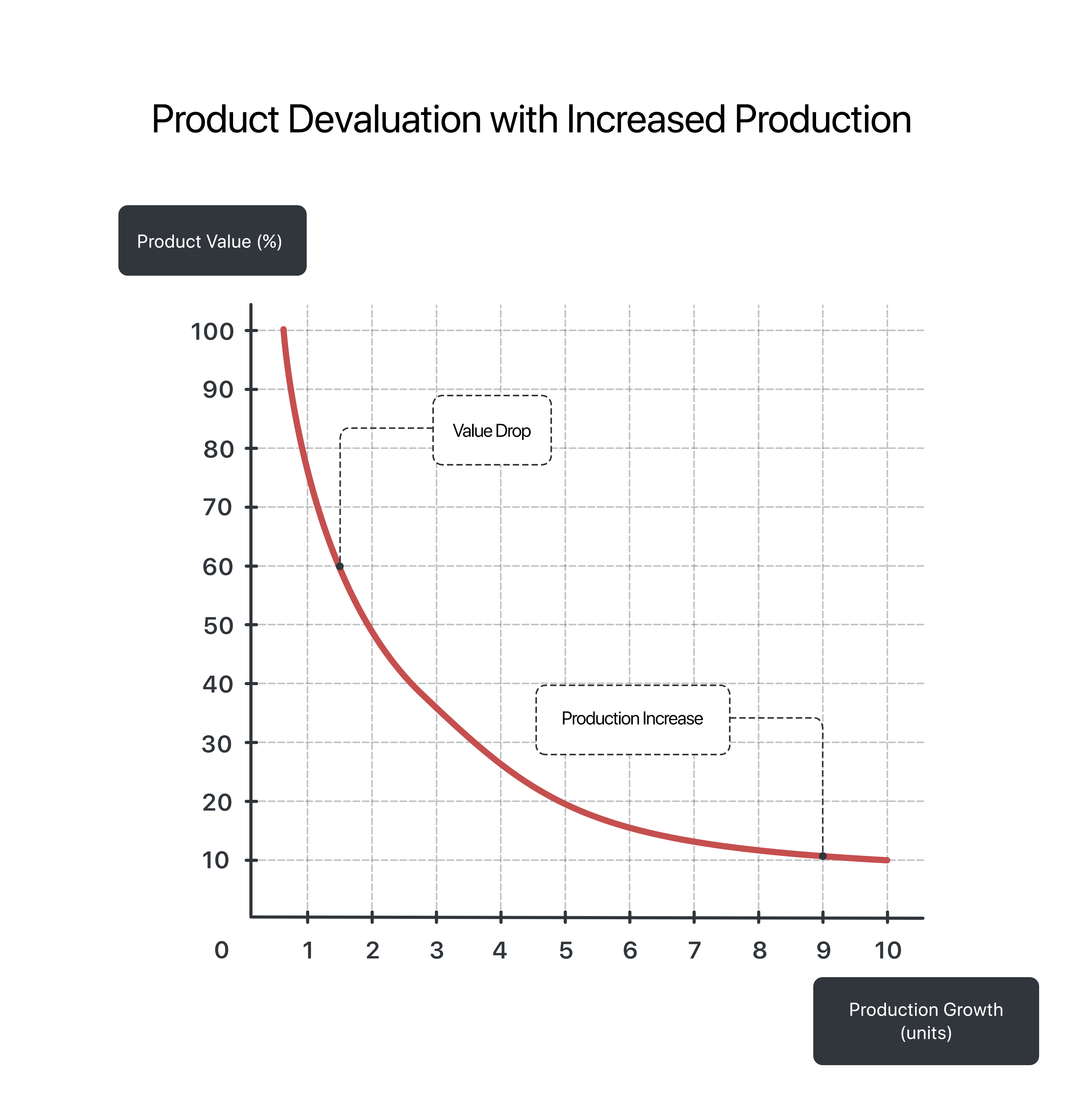

Most products offered by distributor companies are everyday consumables — wellness goods, cosmetics, supplements — and can be manufactured in unlimited quantities. This makes them inherently low in value, as more can always be produced.

- Additionally, such products become outdated quickly. According to DSA, distributor companies typically change their product lines every 3 to 5 years due to declining customer interest and falling sales.

- Similar products are easily replicated by competitors and sold at lower prices, further reducing their perceived value and profitability.

- As a result, participants in such projects lack a long-term product that can be held for years, passed down as an asset, or potentially increase in value over time.

Supporting data:

According to DSA (2023) and the MLM Research Center (2022):

- 67% of participants are left with illiquid inventory,

- companies are forced to refresh their product lines every 3–5 years due to declining demand,

- unlimited production leads to product devaluation.

Problem 5: Most products and tokens do not increase in value and lose it quickly

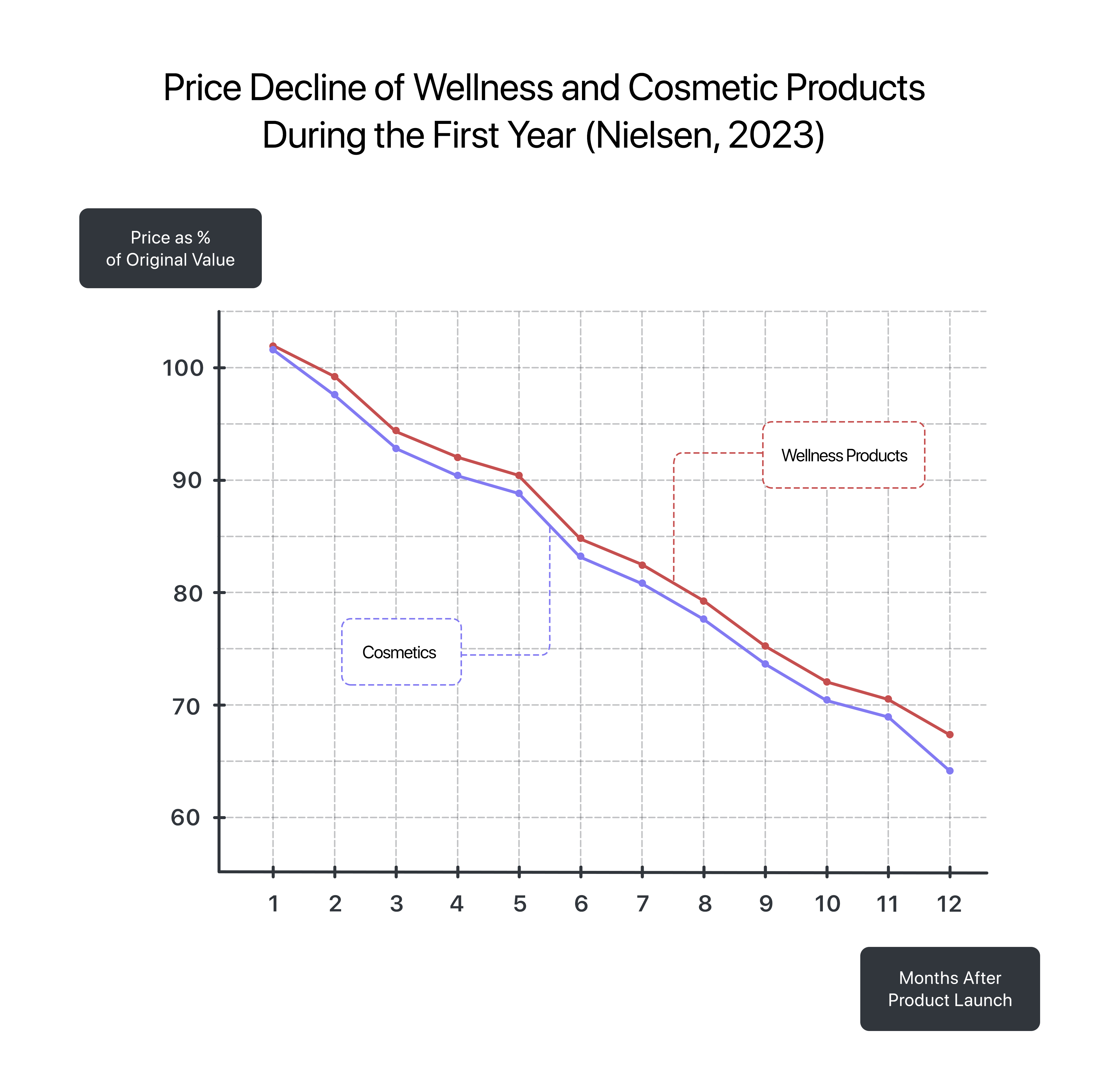

The products offered by distributor companies — such as wellness items, cosmetics, and similar goods — never increase in price. On the contrary, they tend to decrease in value over time. Once purchased, these products lose consumer appeal, especially when mass-produced.

The same applies to most tokens: digital assets without real backing often experience sharp devaluation shortly after their market launch.

Supporting data:

According to Nielsen (2023), prices for wellness and cosmetic products typically decline within the first year after release.

According to CoinGecko (2022), tokens that are not backed by real assets lose up to 90% of their value within the first year.

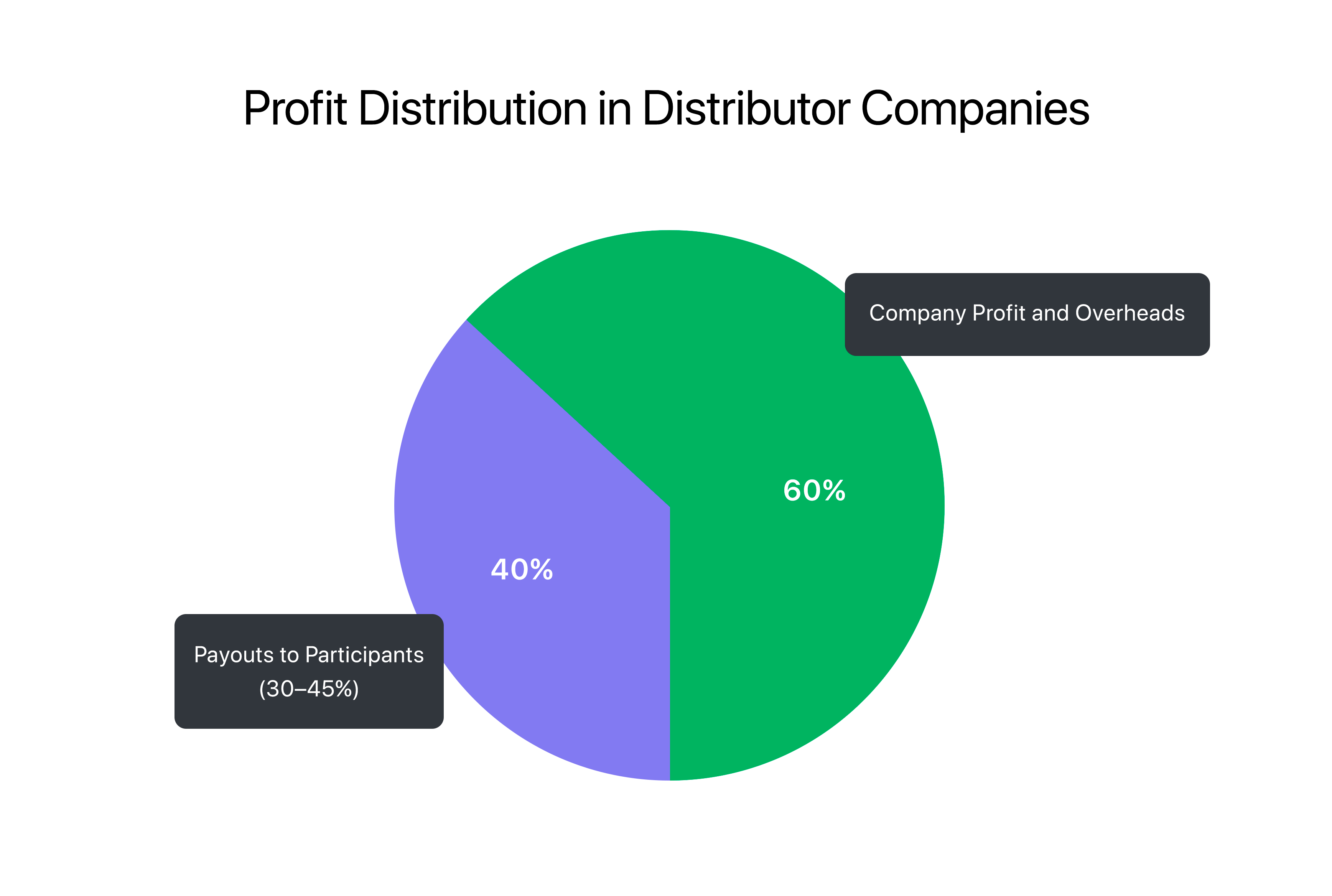

Problem 6: In distributor companies, a significant portion of revenue is spent on production, logistics, and marketing — not shared with participants

On average, only 30–45% of total revenue is allocated to participant payouts. This limits income even for the most active distributors.

At the same time, it is the participants who generate the core value of the business — yet they do not receive a proportionate financial return.

Supporting data:

According to DSA (2023), only 30–45% of a distributor company’s turnover is returned to participants as bonuses. The rest goes toward operational costs and company profits.

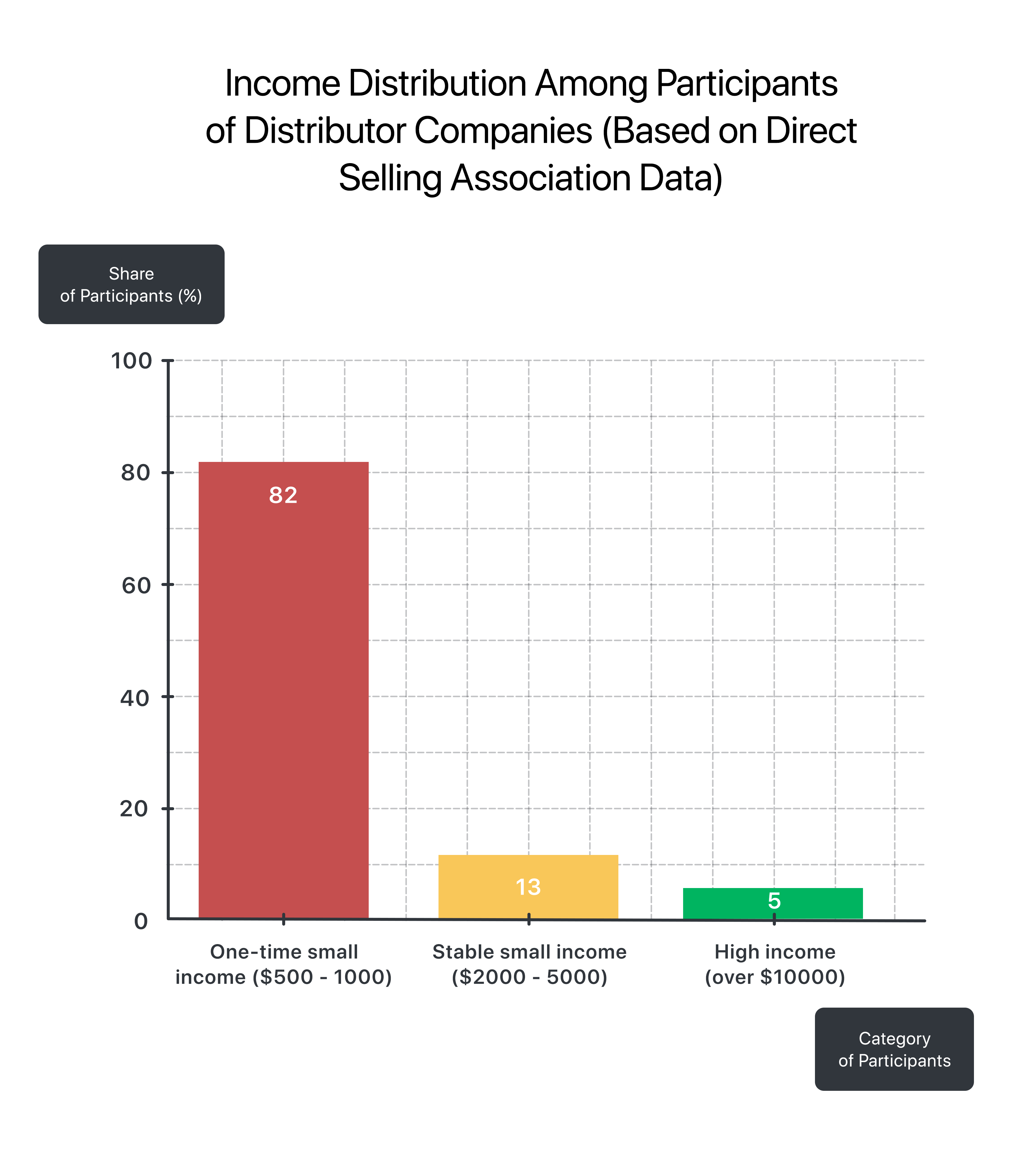

Problem 7: Low profitability and lack of asset-building opportunities

In distributor companies, most participants receive only one-time income, which is fully spent and does not turn into capital.

There is no mechanism that allows participants to create long-term assets or passive income sources — such as real estate or equity in a business.

As a result, even after years of active work, participants are left without savings or protective assets.

Supporting data:

According to the Direct Selling Association (DSA), 82% of distributor company participants earn just enough for current expenses and have no savings.

Only 5% earn over $10,000 per year, but even they lack tools to convert that income into lasting assets within the company model.

Problem 8: Frequent changes in marketing conditions and lack of guarantees for participants

In most distributor companies, marketing plan conditions change regularly — often without prior notice to participants.

Participants calculate their income and plan their activity based on current rules, but sudden changes in the system lead to a sharp drop in profitability and make long-term planning impossible.

These unpredictable changes undermine trust, create uncertainty, and make it difficult to build a stable business.

Supporting data:

According to the Direct Selling Association (DSA, 2023), around 60% of participants report that changes to marketing terms negatively affect their income and hinder long-term financial planning. Frequent adjustments to conditions are one of the key reasons for declining trust and participant attrition.

Our Solution

After analyzing the key issues in the markets of distributor companies, referral programs, and crypto projects, we concluded that building a sustainable and fair business model requires solving several challenges at once: offering participants a clear, in-demand, and liquid product,

- ensuring high and growing income,

- enabling the creation of long-term assets, not just one-off earnings,

- and lowering the entry barrier so that the business is accessible to a wide audience.

The answer to these challenges is a multi-level referral program, launched through NFT Metavanguard.

Unlike typical “meme tokens” or collectible pictures, NFT Metavanguard is a business access tool — a gateway to a system that connects the potential of digital assets with the distributor model.

NFT Metavanguard bridges Web2 and Web3

Problem 1: Most products are designed either for traditional distributors or for the crypto-native audience.

Solution:

NFT Metavanguard is a universal product that connects two of the largest and most financially motivated audiences — both seeking profitable assets and passive income:

- Web2 audience: distributors, traditional entrepreneurs, and freelancers.

According to global industry associations, there are 181.1 million network marketers and 582 million entrepreneurs and self-employed individuals worldwide.

For this group, Metavanguard offers a clear capital accumulation model through an NFT product embedded in a referral system. - Web3 audience: active users of crypto technologies.

As of today, more than 420 million people globally engage with cryptocurrencies and NFTs.

For them, Metavanguard provides a revenue-generating tool with the ability to earn independently of market fluctuations — thanks to a multi-level referral program.

In this way, NFT Metavanguard is accessible and appealing to both Web2 and Web3 users, significantly expanding the potential market and enabling participants to build international teams — without being limited to their personal network.

2. Transactional Advantages

Problem: Referral programs often face payout issues and country-specific restrictions.

Solution:

With Metavanguard, all financial operations — including purchasing and selling NFTs and withdrawing referral bonuses — are conducted on the blockchain, ensuring:

- Fast and anonymous transfers without banking restrictions

- No bureaucratic limits or country-based blocks

- Minimal fees on international transactions

For the Web3 audience (crypto enthusiasts), this is already a familiar and seamless experience.

The uniqueness of Metavanguard lies in the fact that these advantages are now also available to Web2 users — entrepreneurs, freelancers, and distributors who often face:

- payment delays and blocks,

- high transaction fees,

- and complications with international settlements.

As a result, Metavanguard eliminates a major barrier to global business growth, allowing users to build international teams without fear of not receiving earned income.

3. Collectibility and Guaranteed Buyback

Problem: Products in traditional distributor companies are not designed for resale at a profit — they are purchased solely for personal use.

Solution:

Metavanguard plans to release 195 unique collections, each dedicated to one country of the world.

Each collection includes:

- 1 stylized character reflecting the national identity of the country

- 12 country symbols, representing key cultural or historical artifacts

- 12 character interactions with each symbol, forming a unique set of 12 NFTs

Metavanguard NFTs are issued in the format of digital chests, introducing gamified collectibility mechanics. Participants are given a guaranteed buyback option from the platform once a full collection is assembled — at fixed rates.

Types of NFTs in Metavanguard:

- Standard NFTs — static, full-color 3D art

- Prize NFTs — animated 3D art, available in three rarity levels:

- Color — basic colored collection

- Silver — silver-tier collection

- Gold — gold-tier collection

Holders of collectible NFTs can assemble a complete set of matching rarity. Metavanguard offers guaranteed buyback of these completed collections at the following rates:

- Color — 21× the cost of a single NFT (in ETH)

- Silver — 48× the cost of a single NFT (in ETH)

- Gold — 75× the cost of a single NFT (in ETH)

Participants are also free to sell or trade NFTs through the integrated Auction platform, which enables them to:

- List both standard and prize NFTs at custom prices

- Set their own pricing for each NFT

- Sell rare NFTs at a premium, factoring in their guaranteed buyback value as part of complete collections

4. Limited Supply

Problem: Products in distributor companies can be produced endlessly, which leads to devaluation.

Solution:

Unlike typical distributor products, which can be manufactured in unlimited quantities, NFTs from Metavanguard have a strictly limited supply.

Each collection is released in a fixed amount of 14,440 NFTs.

It’s easy to imagine how valuable the NFTs from the first few collections will become once the community moves on to collections from the ninth, eighteenth, or thirty-sixth countries.

This scarcity ensures that the value of NFTs increases as the community grows.

At the same time, NFT holders are free to sell their assets both via the internal auction and on external NFT marketplaces, profiting from growing demand.

5. Speculative Potential

Problem: Most products and tokens do not appreciate in value and lose it quickly.

Solution:

To understand the value of Metavanguard NFTs, it's useful to compare them with familiar products and assets:

- Wellness products:

These expire. Once past their shelf life, they lose all value. Even if they sell well initially, the profit is short-lived, and any inventory becomes a loss. - Gold:

A classic capital preservation tool. Stable, but slow-growing. It’s reliable — but not profitable in the short term. - NFTs from Metavanguard:

Unlike physical goods, Metavanguard NFTs have high speculative potential.

Yes, like any digital asset, they are volatile.

But this is their key advantage — prices can skyrocket in a short time.

These are assets that can deliver significant returns due to demand and scarcity, not just preserve value.

As a result, Metavanguard NFTs combine fast growth potential, limited edition value, and integration into a business system — boosting the profitability of the referral program by up to 2×.

6. 90% of Revenue Goes to the Network

Problem: In distributor companies, the majority of profits go to the company — not the participants.

Solution:

In most distributor companies, participants receive no more than 30–50% of total turnover, with the remainder used to cover costs: production, logistics, storage, quality control, marketing, and owner profits.

Metavanguard offers a fundamentally different approach:

90% of NFT sales revenue is distributed to the network — directly to participants.

This is possible because it’s a digital product that does not require expenses for manufacturing, warehousing, logistics, quality assurance, or expiration tracking.

As a result, Metavanguard participants earn nearly twice as much as in traditional distributor companies — for the same amount of work.

While most traditional companies cap network payouts at around 50%, Metavanguard allocates 90%.

7. Multi-Level Referral Program with High KPI

Problem: Low profitability and lack of asset-building opportunities.

Solution:

The Metavanguard multi-level referral program is a comprehensive reward system that enables participants to:

- Earn initial capital

- Generate passive income

- Accumulate real-world assets through tokenized real estate

The program includes three core compensation plans, each serving a distinct financial function within the project ecosystem.

7.1 Structure of the Referral Program

- Binary Plan – Generates starting capital for investment. Participants earn by referring others and progressing to leadership ranks.

- Classic Plan – Provides long-term passive income based on level differentials within the career structure.

- Matrix Plan – Focused on real estate asset accumulation. Each completed cycle rewards the participant with $15,000 in tokenized real estate.

7.2 Tokens

In addition to NFTs, Metavanguard uses three additional tokens, each with a specific role in the ecosystem:

-

MVT (Utility Token)

- Staking tool – Users can earn passive income by locking their tokens.

- Account upgrade – Grants access to exclusive investment opportunities.

- Liquidity farming – Supports lending pools and decentralized trading pairs.

-

RWA (Real World Assets)

- Each token represents a share of a real estate asset.

- It provides ownership rights linked to a specific property.

-

BON (Bonus Token)

- Internal points system for the referral program, used similarly to PV (Personal Volume) in traditional direct selling companies.

- BON tokens track and calculate bonuses earned through the platform.

7.3. How We Earn: Bonus Examples from the Binary Plan

The Binary Plan is built around the structure of two teams — left and right. Rewards are given for attracting new participants and closing binary cycles.

Core Bonuses of the Binary Plan

Retail Bonus – 20% from each new activation

Participants receive a fixed 20% commission for every new partner personally referred.

Example calculation:

If a new partner activates with 0.9 ETH, the referring participant receives

0.18 ETH (≈ $540) in BON tokens.

Sales Bonus – 10% per binary cycle

A reward is given for each binary cycle closed, which happens when a certain team balance is achieved:

Binary cycle is triggered when one of the following structures is formed:

- 2/4 (2 members in one team, 4 in the other)

- 4/2

- 3/3 (equal distribution)

Example calculation:

If a participant closes a binary cycle (6 activations), average activation cost = 0.9 ETH:

- 0.9 ETH × 6 = 5.4 ETH (cycle volume)

- 10% of 5.4 ETH = 0.54 ETH (≈ $1,620) — bonus for closing the cycle

Matching Bonus – 50% of first-line partners’ earnings

Participants earn 50% of the bonus income their first-line referrals receive.

Example calculation:

If a referral earns $3,000, the sponsor receives $1,500 as Matching Bonus.

Quick Start Bonus – bonus for fast onboarding

An additional incentive for participants who actively expand their team within the first 30 days of activating their own Metavanguard membership.

Bonus tiers:

- For the first 3 referrals in 30 days – 0.3 ETH (≈ $900)

- For each additional referral – 0.2 ETH (≈ $600)

Quick Start KPI Bonus

If 9 partners activate within the first 30 days via your referral link:

- First 3 partners – 0.3 ETH

- Next 6 partners – 0.2 ETH × 6 = 1.2 ETH

- Total Bonus: 0.3 ETH + 1.2 ETH = 1.5 ETH (≈ $4,500)

Example return calculation:

NFT price in the "Optimal" package = 0.15 ETH

Return on investment:

1.5 ETH ÷ 0.15 ETH × 100 = 1,000% ROI

Note: This is a sample scenario. The Quick Start Bonus has no earnings cap.

7.4. Classic Marketing: Income Distribution System

The classic compensation model is based on participant career progression. As their team grows, participants reach new ranks:

- Star – achieved when a participant personally registers 3 partners

- Star Maker and the first leadership rank (1 Star Leader) – reached when at least one personally invited partner becomes a Star for the first time

Income is generated through two main channels:

Active Income

Participants receive a fixed reward for each direct referral.

The bonus amount depends on the participant’s current rank in the system.

Passive Income (Level Differential Bonus)

Participants earn from the total volume of activations within their structure.

The bonus is calculated as the difference between the participant’s level and the levels of their partners who activated during the reporting period.

Example calculation:

A participant at level 5 (252 BON) refers a partner at level 2 (96 BON). For each of this partner’s activations, the participant earns:

- 252 BON – 96 BON = 156 BON (≈ $468)

- If 10 such activations happen during the period: 156 BON × 10 = 1,560 BON → ≈ $4,680 total income

The classic plan allows participants to generate stable passive income, rewarding both personal effort and team growth.

7.5. Matrix Plan: Asset Accumulation Through Tokenized Real Estate

The Matrix Plan operates as a 7-seat structured table that expands as the participant’s team grows.

Each completed cycle rewards the participant with both financial and investment bonuses.

Key Functions of the Matrix Plan

1. Asset accumulation in real estate

Every completed cycle grants the participant $15,000 worth of tokenized real estate, enabling them to accumulate square meters of income-generating properties in Dubai, Bali, and other top tourist destinations.

2. First real estate square meters after reaching Level 5

Upon reaching the fifth leadership level, the participant receives their first real estate asset, valued at $6,000.

This happens through the exchange of their first NFT for RWA tokens, effectively converting a digital collectible into real-world property ownership.

The Matrix Plan empowers participants to accumulate tangible assets, building long-term capital in the form of square meters of profitable real estate.

7.6. DAO LLC: Legal Structure for Real Estate Ownership in Metavanguard

Metavanguard offers participants the opportunity to become co-owners of tokenized real estate through a DAO LLC structure.

This model combines the benefits of decentralized technologies with a solid legal foundation, allowing each partner to securely and officially hold ownership shares in real estate assets.

How DAO LLC Enables Real Estate Ownership in the Project:

1. Legally recognized ownership rights

Each DAO LLC participant officially becomes a co-owner of the property.

This ensures that ownership shares are legally acknowledged and reduces investment risks.

2. Security and limited liability

The LLC structure limits participant liability to the amount of their investment.

This protects personal assets from any company-related risks or obligations.

3. Transparent collective governance

All real estate decisions are made via collective voting by DAO members.

Every action is recorded on-chain using smart contracts, ensuring full transparency and integrity of operations.

4. Process automation

The integration of blockchain and smart contracts enables automated income distribution from rental profits and simplifies asset management across the collective.

Roadmap

2024

Development

- Website development (Q1)

- Launch of the NFT marketplace (Q2)

- Development of the Quick Start mechanics (Q4)

- Launch of the referral program (Q4)

Product

- Creation of the UAE NFT collection (Q2)

- Creation of the China NFT collection (Q3)

- Whitelist announcement for the UAE NFT collection (Q4)

Marketing

- Launch of advertising campaigns

2025

Development

- Announcement of RWA investment platform development (Q1)

- Development of whitelist mechanics (Q2)

- Launch of the UAE NFT whitelist (Q2)

- Start of sales for the UAE NFT collection (Q2)

- Development of MetaWallet (Q3)

Product

- Launch of NFT collections for the UAE, China, and USA

- Integration of AI into the NFT marketplace (Q4)

- Launch of the first RWA properties on Metavanguard.estate (Q4)

Marketing

- Launch of partnerships with Web3 projects, NFT platforms, and RWA initiatives (Q2)

- First Metavanguard community events (Q4)

- Educational campaigns on RWA investments

2026

Development

- Development of DeFi liquidity mechanisms for RWA tokens (Q1)

- Launch of MVT token (Q2) (previously scheduled for 2025)

- Mobile app development (Q4)

- Integration of liquidity tools for RWA tokens (Q4)

Product

- Launch of NFT collections for 12 countries (Q1)

- Expansion of the RWA property catalog (Q2)

Marketing

- Large-scale advertising campaigns

- Launch of partnership initiatives

- Token holder events (Q2)

- Launch of RWA investment ambassador program

2027

Development

- IDO launch (Q1)

- Development of the MetaWallet card (Q3)

- Integration with payment systems and crypto exchanges (Q3)

- Implementation of community voting and governance mechanisms (Q4)

- Deployment of RWA investor lending tools (Q4)

Product

- Launch of NFT collections for 7 countries (Q1)

- NFT collections for 7 more countries (Q2)

- NFT collections for 7 more countries (Q3)

- NFT collections for 10 countries (Q4)

- Expansion of the list of countries available for RWA investment (Q4)

Marketing

- International conferences and events

- Partnerships with leading crypto platforms and investment funds

2028–2029

Development

- Introduction of virtual worlds and metaverse integration (Q2 2028)

- Launch of Metavanguard VR set (Q2 2028)

Product

- NFT collections for 48 countries (Q1 2028)

- NFT collections for 101 countries (Q1 2029)

- Global scaling of the RWA investment platform

Marketing

- International offline events (Q4 2028)

- Global marketing campaign promoting RWA investments

Conclusion

Metavanguard addresses seven critical problems found in distributor companies, referral systems, and crypto projects.

By combining NFTs, blockchain technology, and real-world assets, the project enables participants to:

- earn significant income regardless of market conditions

- accumulate assets in the form of tokenized real estate in high-demand tourist destinations around the world

Unlike traditional models, Metavanguard provides a sustainable solution, ensuring:

- stability,

- transparency,

- and steady growth in asset value over time.

VI. List of Statistical Sources Used in the Metavanguard White Paper

- Direct Selling Association (DSA). Industry Statistics.

https://www.dsa.org/statistics-insights/industry-statistics - Forbes Finance Council (2023). The Global Cryptocurrency Market: A Decade Of Growth And What Comes Next. Forbes.

https://www.forbes.com/sites/forbesfinancecouncil/2023/01/10/the-global-cryptocurrency-market-a-decade-of-growth-and-what-comes-next/ - Direct Selling Association (DSA). Global Regulatory Issues.

https://www.dsa.org/advocacy/regulatory-issues - PwC (2022). Direct Selling in the Digital Age.

https://www.pwc.com/gx/en/industries/consumer-markets/retail-consumer/consumer-insights-survey/direct-selling-in-the-digital-age.htm - Statista (2023). Global Wellness Market Size.

https://www.statista.com/statistics/1255243/global-wellness-market-size/ - Statista (2023). Cosmetics Industry Worldwide.

https://www.statista.com/topics/3137/cosmetics-industry/ - Direct Selling Association (DSA). Industry Facts.

https://www.dsa.org/statistics-insights/industry-facts - MLM Research Center (2022). Product Life Cycles in Direct Selling.

https://www.mlmrc.com/articles/product-life-cycles-in-direct-selling/ - Nielsen (2023). Global Consumer Trends.

https://www.nielsen.com/insights/2023/global-consumer-trends/ - CoinGecko (2022). Cryptocurrency Market Overview.

https://www.coingecko.com/en/global-charts - Direct Selling Association (DSA). Compensation Plan Overview.

https://www.dsa.org/benefits/research/compensation-plan-overview - Direct Selling Association (DSA). Earnings Disclosure Statement.

https://www.dsa.org/consumer-protection/earnings-disclosure